Fix Your Finances

The COVID-19 global pandemic is a wake-up call to ALL business owners to take responsibility for their company finances.

I posted that financial advisors are responsible for the companies they work with to have good financial plans, including a 13-week cash flow model. Now, I am putting the responsibility 100% onto business owners. There are no more excuses.

For too long business owners have said...

"It's not about the money, it's about the people."

"I do it for the love of my craft."

"Someone else can deal with the finances."

"I want to be my own boss, but so I decide that I only want basic bookkeeping."

Now a tiny virus has told you that you are wrong.

You are in business. Business is about the numbers.

Not only numbers, but if you don't have money, you can't...

...help people

...work your craft

...let someone else worry

...be your own boss

If you survive this downturn, fix your finances.

Start with a cash flow model that tells you how long you can survive. (Put "Cashflow" in the comments if you wa...

Focus On Where You Want to Go, Not Where You Don't

The first time I went skiing as a teenager I watched my classmate beautifully ski down the hill and, in slow motion, turn gently to the left and ski into a barn.

The barn wasn't anywhere near the bottom of the run. It was way far away and posed no danger to anyone. But as the instructor shouted "Stay away from the barn!" her turn became sharper until she was pointed directly at the big, red barn!

I suspect that her problem was that she focused on "not hitting the barn" instead of going straight.

That's a lot like when in business we are focused on preventing a result instead of focusing on the result we do want. We often end up "hitting the barn" instead of getting the result.

When I ski and I'm moving fast, I always need to focus on where I need to go and I consciously block thinking about obstacles that could cause danger. I know the danger is there, but I focus on where I want to go.

The same in business. Focus on where you want to go.

I'd love to hear any comments you've had,...

Payne Points of Interest #95 In regards to COVID-19

"Lenders prefer cash flow models, not just a profit and loss statement."

Cash Forecast vs. Cash Flow vs. Cash Management– Good Tools

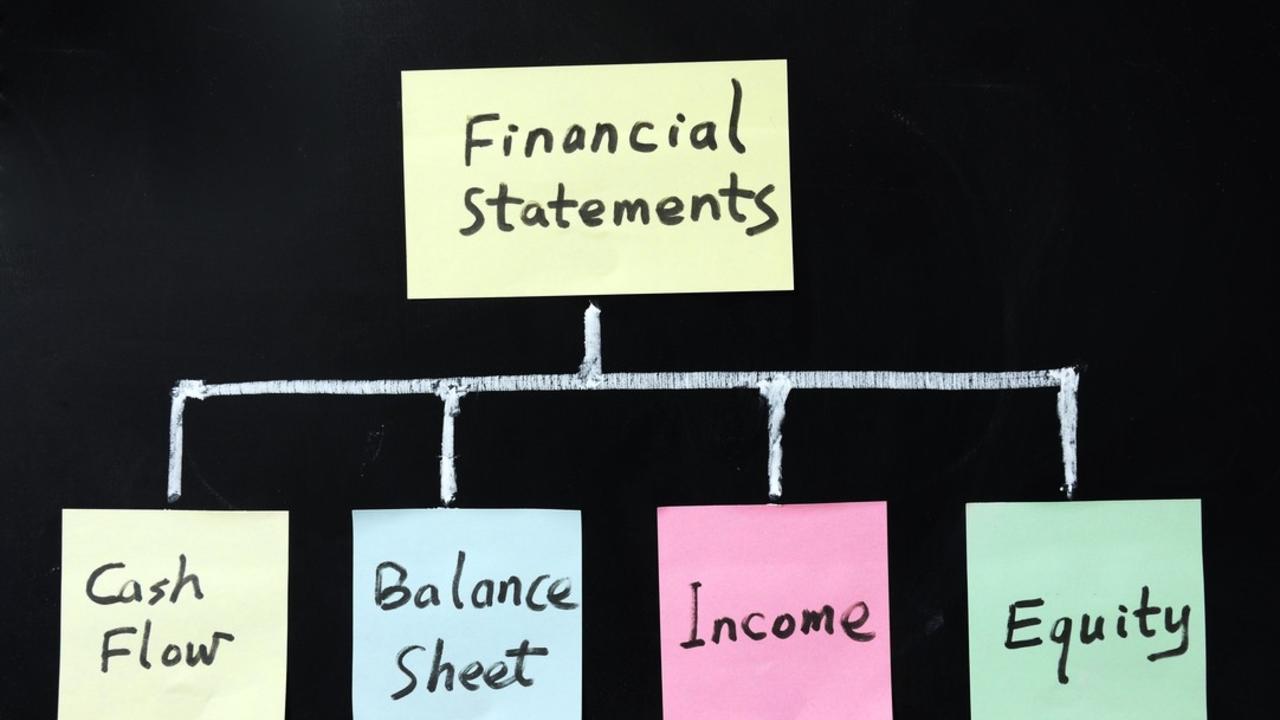

Most people think that cash management, cash flow, and cash forecast are the same - they are not. If you don’t know the difference, you may have a false sense of security about where you are and the progress you are making.

Even if you do know the differences between the three, you also need to know how to use them to run your business.

I’ll give you a rundown of each one, what they are used for, and some key ideas for using them to run your business.

What is a “Cash Forecast” and What is It Good For?

A cash forecast is a way to predict when cash is coming in and going out, based on your business model. I like to call this “business modeling” because it creates a sense of how your business is run. Sometimes it is also called “cash modeling.”

A cash forecast is also a predictive model of your cash-based profit and loss statement.

Cash forecasts are usually set-up for monthly calculations, which go out 1-3 years. They use cash-basis accounting, and have estimates of your revenue, ...